bestmarketing.site

Learn

What Is A Auto Equity Loan

:max_bytes(150000):strip_icc()/Primary-Image-how-to-get-an-auto-equity-loan-7484972-92d6e89bfb6842c2ad4b90d541a53b8b.jpg)

To get a car equity loan, the borrower typically needs to own the vehicle outright and provide the title as security. They also need to submit. Find out if either an auto or home equity loan would be a cheaper source of financing when buying a car or other vehicle. A Best Egg Vehicle Equity Loan empowers you to leverage the value of your car to secure a loan from $2, to $,, subject to credit approval. The minimum. A cash-out auto refinance is different than traditional auto loan refinancing, in that you are asking the lender to loan you cash based on the equity in your. Reprise Financial Auto Equity Loans offers auto equity loans with a fixed APR that ranges from % up to 36%. Title Equity Loans allow you to get cash today. Your loan amount is determined based on the available equity of your vehicle. You can borrow up to % of your car's equity. You'll also enjoy convenient repayment terms up to 7 years in length. The five reviewed providers of auto equity loans for bad credit are excellent options when you need to unlock the value you've accumulated in your current car. With TruChoice car equity loans, you can borrow up to % of the full value of your vehicle. Instead of putting expenses on high interest credit cards or. To get a car equity loan, the borrower typically needs to own the vehicle outright and provide the title as security. They also need to submit. Find out if either an auto or home equity loan would be a cheaper source of financing when buying a car or other vehicle. A Best Egg Vehicle Equity Loan empowers you to leverage the value of your car to secure a loan from $2, to $,, subject to credit approval. The minimum. A cash-out auto refinance is different than traditional auto loan refinancing, in that you are asking the lender to loan you cash based on the equity in your. Reprise Financial Auto Equity Loans offers auto equity loans with a fixed APR that ranges from % up to 36%. Title Equity Loans allow you to get cash today. Your loan amount is determined based on the available equity of your vehicle. You can borrow up to % of your car's equity. You'll also enjoy convenient repayment terms up to 7 years in length. The five reviewed providers of auto equity loans for bad credit are excellent options when you need to unlock the value you've accumulated in your current car. With TruChoice car equity loans, you can borrow up to % of the full value of your vehicle. Instead of putting expenses on high interest credit cards or.

With an auto equity loan, you can get a short-term, high-interest loan based on the equity in your car — its resale value minus the amount you still owe — while. Auto equity loans are like home equity loans; the only difference is that instead of using your home as collateral, you will use your vehicle. The answer to your question might seem easy — choose the home equity loan for the tax benefits — it is not always that simple. How Do I Get an Auto Equity Loan? Auto Equity Loans are made pursuant to a CA Dept. of Justice Pawnbrokers License # Loans are subject to approval. An auto equity loan is a secured loan based on the value of the vehicle you own. You can determine how much equity you have by finding the difference between. Need some cash, but don't want an additional loan payment, why not use the equity of your vehicle loan that is financed at CRCU. Premier Title Loans offers auto equity loans that use your car as collateral for a loan. Most newer cars will qualify and you don't need good credit! This is the total cost of your auto purchase. Include the cost of the vehicle, additional options and destination charges. Don't include sales tax in this. Using home equity to buy a car: How it works. Home equity is the difference between your home's value and your outstanding mortgage balance — it's the portion. Auto Equity Loan. Model car on stacks of money. We offer Auto Equity loans. With an Auto Equity Loan, you may be able to take your free and clear. Yes. Auto equity loans aren't very common, but they let you borrow money using your car as collateral. Your auto loan equity is the difference between how much. Use our auto loan vs. home equity loan calculator to see if you should use a home equity loan to buy a car. You can get a loan without having to drive around town or even step foot out of your home. Apply for an auto equity loan online in 3 steps and get cash in. Auto Equity Loan · Terms of up to five years · Option to borrow % of the clean trade value · Lower rates compared to unsecured loans · Low rate APR, depending. If you own your vehicle and need cash fast, you could be eligible for an Auto Equity Loan. Use your car as collateral to secure a loan and get more money. Title loans allow you to use your car's title to secure a loan quickly. Unlike selling your car, you're only temporarily loaning out the equity in exchange for. Use this calculator to compare costs for taking out an auto loan versus a home equity loan. This calculator is for general education purposes only. Using home equity to buy a car: How it works. Home equity is the difference between your home's value and your outstanding mortgage balance — it's the portion. We are proud to offer fast financing for most instant auto equity loans, and we can get you approved in less than 24 hours!

Blagf

In depth view into BLAGF (Blue Lagoon Resources) stock including the latest price, news, dividend history, earnings information and financials. Blue Lagoon Resources (BLAGF) advanced chart and technical analysis tool allows you to add studies and indicators such as Moving Averages (SMA and EMA). Track Blue Lagoon Resources Inc (BLAGF) Stock Price, Quote, latest community messages, chart, news and other stock related information. BLAGF; Company Profile. BLAGF. Blue Lagoon Resources Inc. Ordinary Shares. %. / ( x ). Real-Time Best Bid & Ask: Key Data for Blue Lagoon Resources Inc. (BLAGF:US), including dividends, moving averages, valuation metrics, and more. View BLUE LAGOON RESOURCES INC (BLAGF) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Real-time Price Updates for Blue Lagoon Resources Inc (BLAGF), along with buy or sell indicators, analysis, charts, historical performance, news and more. (the "Company") (CSE:BLLG)(FSE:7BL)(OTCQB:BLAGF) announces a private placement ACCESSWIRE•8 months ago. Get stock insights, analysis and discussion about Blue Lagoon Resources Inc (OTCQB:BLAGF). Join the BLAGF discussion on Canada's largest online investor. In depth view into BLAGF (Blue Lagoon Resources) stock including the latest price, news, dividend history, earnings information and financials. Blue Lagoon Resources (BLAGF) advanced chart and technical analysis tool allows you to add studies and indicators such as Moving Averages (SMA and EMA). Track Blue Lagoon Resources Inc (BLAGF) Stock Price, Quote, latest community messages, chart, news and other stock related information. BLAGF; Company Profile. BLAGF. Blue Lagoon Resources Inc. Ordinary Shares. %. / ( x ). Real-Time Best Bid & Ask: Key Data for Blue Lagoon Resources Inc. (BLAGF:US), including dividends, moving averages, valuation metrics, and more. View BLUE LAGOON RESOURCES INC (BLAGF) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Real-time Price Updates for Blue Lagoon Resources Inc (BLAGF), along with buy or sell indicators, analysis, charts, historical performance, news and more. (the "Company") (CSE:BLLG)(FSE:7BL)(OTCQB:BLAGF) announces a private placement ACCESSWIRE•8 months ago. Get stock insights, analysis and discussion about Blue Lagoon Resources Inc (OTCQB:BLAGF). Join the BLAGF discussion on Canada's largest online investor.

View the latest Blue Lagoon Resources Inc. (BLAGF) stock price, news, historical charts, analyst ratings and financial information from WSJ. The stock price for Blue Lagoon Resources (OTCQB: BLAGF) is $ last updated Today at August 3, at AM EDT. Blue Lagoon Resources Inc. (BLAGF.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Blue Lagoon Resources Inc. | OTC. Current quotes, charts, news, historical data, and analysis for BLUE LAGOON RESOURCES INC (BLAGF) Stock. Blue Lagoon Resources Inc. analyst ratings, historical stock prices, earnings estimates & actuals. BLAGF updated stock price target summary. CSE: BLLG OTC: BLAGF Frankfurt: 7BL · BLLG Chart by TradingView. Blue Lagoon Resources Inc. (BLAGF) related stocks - discover similar stocks, compare dividends and return. Compare momentum and price performance. Get the latest insights on Blue Lagoon Resources Inc. (BLAGF) with press releases and corporate news to help you in your trading and investing decisions. Get stock insights, analysis and discussion about Blue Lagoon Resources Inc (OTCQB:BLAGF). Join the BLAGF discussion on Canada's largest online investor. The latest Blue Lagoon Resources stock prices, stock quotes, news, and BLAGF history to help you invest and trade smarter. Get the latest Blue Lagoon Resources Inc (BLAGF) real-time quote, historical performance, charts, and other financial information to help you make more. See the latest Blue Lagoon Resources Inc Ordinary Shares stock price (BLAGF:PINX), related news, valuation, dividends and more to help you make your. Blue Lagoon Resources (BLAGF) has a Smart Score of N/A based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom. Blue Lagoon Resources Inc. (BLAGF) is a mining company based in Vancouver, BC, focused on the Dome Mountain gold project. The company recently achieved. Get the latest Blue Lagoon Resources Inc. (BLAGF) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Blue Lagoon Resources Inc. research and ratings by Barron's. View BLAGF revenue estimates and earnings estimates, as well as in-depth analyst breakdowns. Real-time Price Updates for Blue Lagoon Resources Inc (BLAGF), along with buy or sell indicators, analysis, charts, historical performance, news and more. Company profile for Blue Lagoon Resources Inc (BLAGF) including business summary, key statistics, ratios, sector. Blue Lagoon Resources Inc. (BLAGF) has a market cap of $ and a live price of $ Check more stats and compare it to other stocks and crypto. View BLUE LAGOON RESOURCES INC (BLAGF) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo.

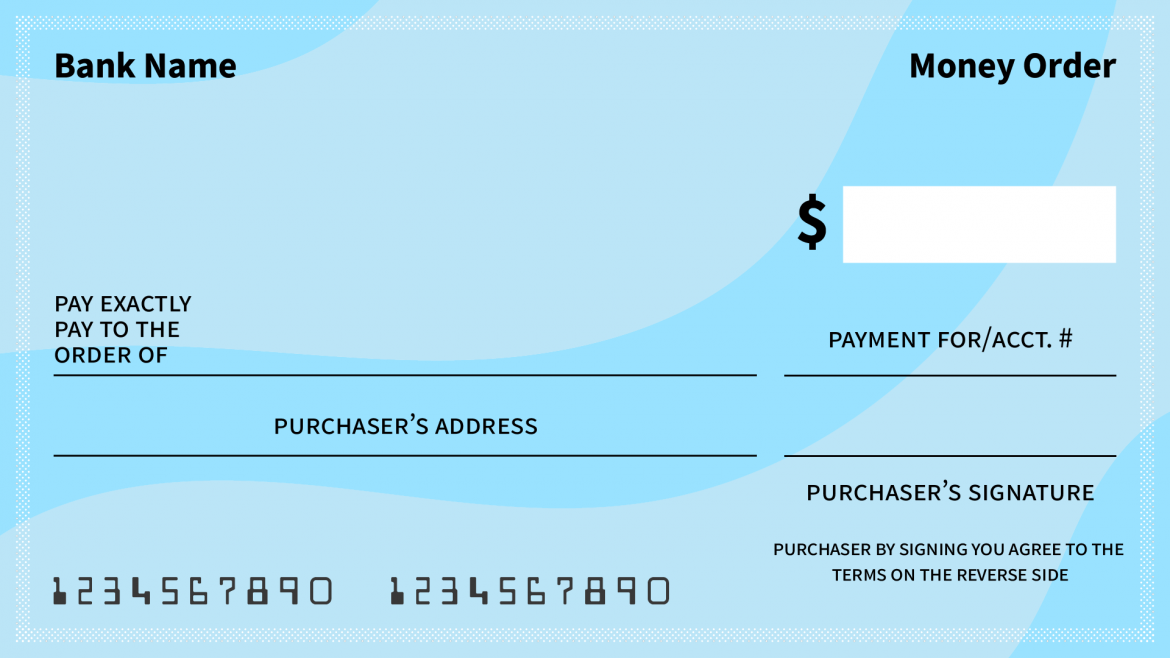

Does Walgreens Make Money Orders

Does Walgreens do money orders? Similar to CVS, Walgreens offers money orders through Western Union. Can you pay for a money order with a debit card? You. It's your Walgreens - shop and manage your prescriptions. Prescriptions • Refill in a snap by scanning your barcode • Track order status for you and your. No, Walgreens does not sell money orders. It does, however, sell money transfers via Western Union. The difference between a money order and a money transfer is. Transfers within Stash between your Stash banking account and portfolio(s) are instant, so you can get immediate access to your money. Note: Transfers out. Walgreens sells both prescription and non-prescription drugs through its retail stores. Further, it also provides pharmacy services like prescription fulfilment. How do I shop bestmarketing.site? Under the menu tab near the top left corner choose Shop products. For prescription order choose Prescriptions. You can pay for bestmarketing.site orders with a debit card, Visa, MasterCard, Discover Network or American Express. You can also pay with PayPal, PayPal Credit. They can also be found at pharmacies across Philadelphia and other U.S. cities such as CVS and Walgreens, as well as at many convenience stores like 7-Eleven. Money orders offer a reliable, convenient alternative to cash or a check. Buy and cash money orders at a Western Union location near you. Does Walgreens do money orders? Similar to CVS, Walgreens offers money orders through Western Union. Can you pay for a money order with a debit card? You. It's your Walgreens - shop and manage your prescriptions. Prescriptions • Refill in a snap by scanning your barcode • Track order status for you and your. No, Walgreens does not sell money orders. It does, however, sell money transfers via Western Union. The difference between a money order and a money transfer is. Transfers within Stash between your Stash banking account and portfolio(s) are instant, so you can get immediate access to your money. Note: Transfers out. Walgreens sells both prescription and non-prescription drugs through its retail stores. Further, it also provides pharmacy services like prescription fulfilment. How do I shop bestmarketing.site? Under the menu tab near the top left corner choose Shop products. For prescription order choose Prescriptions. You can pay for bestmarketing.site orders with a debit card, Visa, MasterCard, Discover Network or American Express. You can also pay with PayPal, PayPal Credit. They can also be found at pharmacies across Philadelphia and other U.S. cities such as CVS and Walgreens, as well as at many convenience stores like 7-Eleven. Money orders offer a reliable, convenient alternative to cash or a check. Buy and cash money orders at a Western Union location near you.

If you live near a Capital One Café or Capital One bank location, you can make a check or cash deposit at an ATM at that location. Make a transfer. If you need to make a payment or send funds, a money order can be a safe alternative to a personal check or cash. You can typically buy one with a debit. liquor department items, phone/prepaid/gift cards, money orders/transfers No, but if you join myWalgreens, you can earn Walgreens Cash rewards on the. Always make a copy of your money orders for your records! We have shared two common examples below. If you purchase a money order that does not match the. Western Union. Safely send and receive money with ease at your nearest Walgreens location. Learn more. For example, there are many grocery stores, such as Publix, Meijer and Winn-Dixie that sell money orders, but do not cash them. However, you still do have quite. Adding money to Checking is easy. There's no minimum, and lots of ways to do it. Add money within 60 days of opening your account, or it'll close and you'. Earn unlimited 5% Walgreens Cash rewards on Walgreens branded products Save time with our Pickup and Delivery services: Pickup orders ready in as little as Payment Methods ; Walgreens Now also accepting Apple Pay Locations and hours, Yes. Note: We can't accept cash and coin by mail. Learn more about mail deposits · Order deposit slips. Excludes photo orders not picked up in store, prescriptions, tobacco, dairy, liquor department items, prepaid cards, money orders/transfers, transportation. For your convenience, you can get both your Pickup order and your prescriptions at the pharmacy. Get your prescriptions even faster when you prepay with. *Money Order Deposits: Money orders are subject to applicable funds availability schedules which do not include same day availability. Some money orders may be. No fees for cashier's checks, money orders and Frost branded checks. Open now Customers can now chat live in the app or when logged in online with a real. Get access to a trusted pharmacy partner for your prescription needs at prices you'll appreciate. Prescriptions in-store or at your door with pickup or delivery. What do I do if my money order is old and has been turned over to the state as unclaimed property? ; Support · Help Center · Contact Us · MoneyGram App · Fraud. Top 10 Best Money Order in San Jose, CA - August - Yelp - The UPS Store, US Post Office, Thien Truc - Western Union, California Check Cashing Stores. You can deposit paper money into your Cash App balance at participating retailers Walgreens; Walmart*; Wesco; Yesway. *For deposits at Walmart, see your. can I transfer Walgreens Cash rewards between them? I live in a state that cannot earn Walgreens Cash rewards for prescriptions; what else can I earn. The Walgreens care team is available to help answer questions about the discount and how you can get health guidance and support. Walgreens Cash rewards are.

Pay Later Methods

.png)

A down payment may be required. For example, a $ purchase could be split into 12 monthly payments of $ at 15% APR, or 4 interest-free payments of $ Klarna is the largest provider of buy now, pay later services in the world. Buy now pay later, with Afterpay Afterpay offers app-only shopping benefits to give you more access to the brand deals you love. Shop online and in-store in. Afterpay - Buy Now, Pay Later 4+ · Shop fashion, beauty and tech · Afterpay · iPhone Screenshots · Description · What's New · Ratings and Reviews · App Privacy. With Synchrony Pay Later and At Home, you can make purchases now and pay over time in 3 equal monthly payments for purchases ranging from $$ Buy now, pay later, or BNPL, is a type of installment loan. It divides your purchase into multiple equal payments, with the first payment due at checkout. The. Buy now, pay later with these steps ; Choose PayPal at checkout. Then select the Pay Later option that works for you. ; Get a decision in seconds. Choose the. Shop anywhere and choose Zip at checkout to pay later. You'll pay the first installment upfront, and the rest over 6 weeks Get the Zip app. Buy now, pay later, or BNPL, is a payment option where a customer pays for a purchase over time in installments, while merchants get paid in full. With Afterpay. A down payment may be required. For example, a $ purchase could be split into 12 monthly payments of $ at 15% APR, or 4 interest-free payments of $ Klarna is the largest provider of buy now, pay later services in the world. Buy now pay later, with Afterpay Afterpay offers app-only shopping benefits to give you more access to the brand deals you love. Shop online and in-store in. Afterpay - Buy Now, Pay Later 4+ · Shop fashion, beauty and tech · Afterpay · iPhone Screenshots · Description · What's New · Ratings and Reviews · App Privacy. With Synchrony Pay Later and At Home, you can make purchases now and pay over time in 3 equal monthly payments for purchases ranging from $$ Buy now, pay later, or BNPL, is a type of installment loan. It divides your purchase into multiple equal payments, with the first payment due at checkout. The. Buy now, pay later with these steps ; Choose PayPal at checkout. Then select the Pay Later option that works for you. ; Get a decision in seconds. Choose the. Shop anywhere and choose Zip at checkout to pay later. You'll pay the first installment upfront, and the rest over 6 weeks Get the Zip app. Buy now, pay later, or BNPL, is a payment option where a customer pays for a purchase over time in installments, while merchants get paid in full. With Afterpay.

Give Customers More Ways To Pay. Customers love having options—especially when it comes to payments. Synchrony Pay Later gives you the power to offer more—. Click on the pink badge and pay with Klarna at your favorite stores. You can Pay now, Pay in 4 interest-free payments, Pay in 30 days, or Pay over time. Buy-now-pay-later plans allow you to make purchases and pay for them in several (often four) installments. · Credit cards also let consumers pay over time, but. Top 6 apps like Klarna for buy now, pay later options · 1. Affirm. Affirm is one of the most popular buy now, pay later apps. · 2. Laybuy · 3. Sezzle · 4. Sezzle allows you to buy now and pay later! Shop now, get what you need, and pay later in 4 interest-free installment payments over six weeks. Learn more! The Pay Monthly option is available to customers in the U.S., excluding customers in West Virginia, New Mexico, Nevada and Hawaii, and offered at select. PayPal offers short-term, interest-free payments, longer-term, monthly installments, and other special financing options that buyers can use to buy now and pay. Experience Buyer's Joy with a smarter way to pay. · Buy what matters most · Uplift your payment method. · Make surprise-free monthly payments. · Give the Gift of. Give Customers More Ways To Pay. Customers love having options—especially when it comes to payments. Synchrony Pay Later gives you the power to offer more—. When you select Affirm as your payment method, you can break up the total cost of your purchase into affordable monthly installments. That means you can shop at. Buy now, pay later (BNPL) is a type of short-term financing that allows consumers to make purchases and pay for them over time. BNPL is also commonly known. Buy now, pay later is an alternative payment method that lets you make a purchase and pay for it over a series of installments. This payment method is available. Sezzle, the ultimate buy now, pay later shopping app empowering you to buy what you love today and pay in easy, interest-free installments over six weeks. Buy now, pay later (BNPL) is a type of short-term financing that allows consumers to make purchases and pay for them at a future date. PayPal offers short-term, interest-free payments, longer-term, monthly installments, and other special financing options that buyers can use to buy now and pay. Thinkific Payments processed Buy Now Pay Later (BNPL) services from Affirm, Afterpay, Clearpay, and Klarna. During the checkout process, Learners will be. There are plentiful advantages to offering Buy Now Pay Later as a payment method. It opens the doors to new customers while encouraging them to make higher. This means your customers are not limited to credit card transactions. Whether they would like to pay interest-free installments with Buy Now Pay Later, through. Buy Now Pay Later in installments. Offer customers up to 24 months to pay using their own credit card, no hidden fees or added interest. Finance It, splitting the cost of larger purchases into as many as 36 monthly payments. Interest charges can apply. The Buy Now, Pay Later checkout experience.

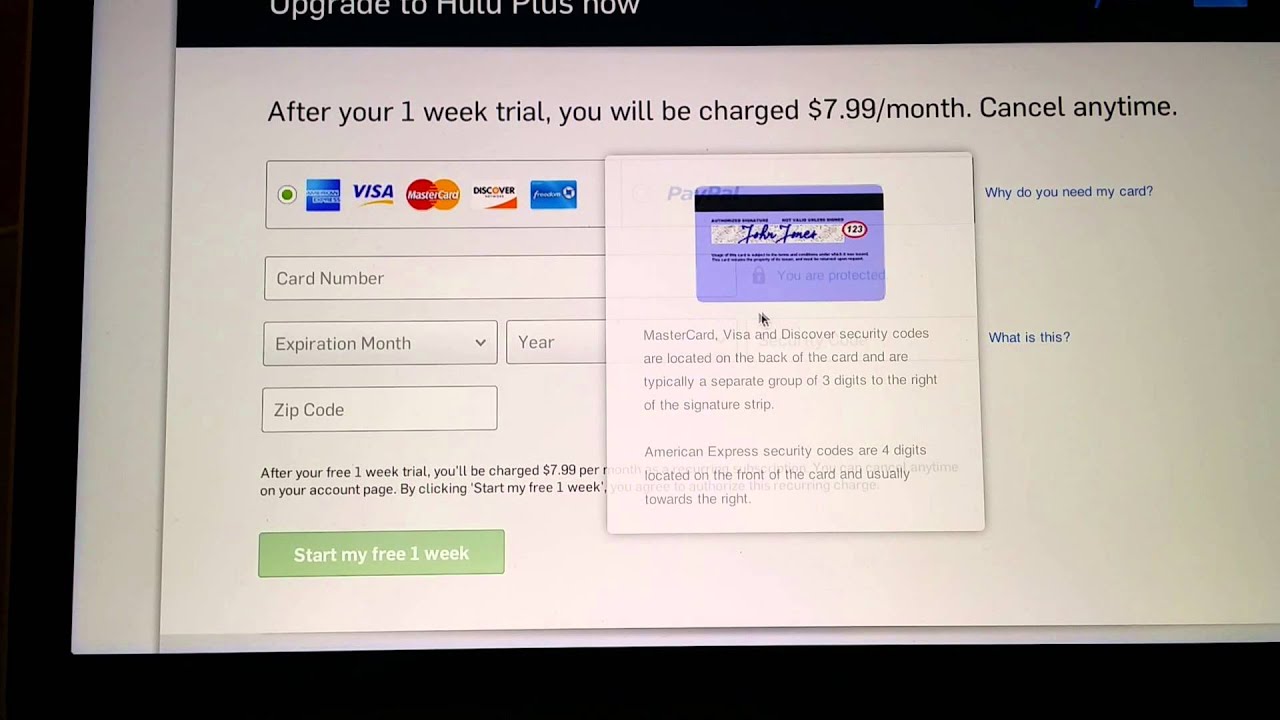

How To Use Free Trial Without Credit Card

We recommend using an incognito (private) window on your browser to ensure seamless sign-up. We do require a credit card during our trial sign-ups right now. Prepaid debit cards that can be loaded with a set amount of funds provide a handy way to sign up for a Semrush free trial without relying on traditional credit. How to Avoid Using Your Credit or Debit Card · Create an Account · Connect A Funding Source · Create a Virtual Card · Sign Up for Your Trials. If you're using NetBanking in India as your primary payment method, you must make a prepayment during the setup to verify your account. We apply the prepayment. We require a credit card to ensure that you have uninterrupted access to this exciting new service and don't have to do anything after your trial period. Of. To make the free trial available without a credit card upfront, click Trial without card: OFF to set it to ON: That's it! Here is what your membership bot. Stripe Checkout lets you sign up customers for a free trial of a subscription service without collecting their payment details. It's possible to use complimentary plans to offer free trials without requiring members to add their credit card details. This method is useful when you want to. While requesting credit cards for free trials is likely to boost your initial trial conversion rates, you might actually get fewer new customers, even if your. We recommend using an incognito (private) window on your browser to ensure seamless sign-up. We do require a credit card during our trial sign-ups right now. Prepaid debit cards that can be loaded with a set amount of funds provide a handy way to sign up for a Semrush free trial without relying on traditional credit. How to Avoid Using Your Credit or Debit Card · Create an Account · Connect A Funding Source · Create a Virtual Card · Sign Up for Your Trials. If you're using NetBanking in India as your primary payment method, you must make a prepayment during the setup to verify your account. We apply the prepayment. We require a credit card to ensure that you have uninterrupted access to this exciting new service and don't have to do anything after your trial period. Of. To make the free trial available without a credit card upfront, click Trial without card: OFF to set it to ON: That's it! Here is what your membership bot. Stripe Checkout lets you sign up customers for a free trial of a subscription service without collecting their payment details. It's possible to use complimentary plans to offer free trials without requiring members to add their credit card details. This method is useful when you want to. While requesting credit cards for free trials is likely to boost your initial trial conversion rates, you might actually get fewer new customers, even if your.

Billing verification. Google asks for a credit card or other payment method when you sign up for the Free Trial. Google uses this payment information for. Create free trials without collecting payment method You can sign customers up for a free trial of a subscription without collecting their payment details in. Your project consists of several steps, from domain registration to SSL certificate. With Artera you can get everything under a single supplier and have every. Free Trial is really % free. Remember, you'll be using your own phone, and no credit card is required to get started. After 30 days, you can go back to. Sign up for free trials without a credit card. These methods include using a debit card, e-wallet, gift card, or other online payment methods. Like anything in business, a free trial will lose its effectiveness if it's implemented without any forethought. get hard data on what the conversion rate for. Adding a credit card to a trial account converts it to a paid account without ending the trial period. During the remainder of the trial period, you can. We require that you provide a valid credit or debit card when you start your free trial to prevent any interruptions to your service. No credit card required. Offer Details below. STEP 1 OF 3. Check your eligibility. Personal Information. Search by License Plate. Radio ID / VIN. No radio? Get. use a credit card to try a YouTube TV free trial. Follow these steps to cancel using a virtual card provider: Go to one of the virtual card providers (e.g. Free Trial Without a Credit Card ; Start Trial Later. Join Free. Free forever. Start trial later. ; Continue w/o CC. $99/month. Start your day free trial. Free trial - customers can start a free trial without needing to enter a credit card. If customers don't convert at the end of the trial period, they lose. without pulling out my credit card! Who wouldn't? But what buyers often get wrong is they think that this is some sort of predatory customer acquisition. Adding a credit card to a trial account converts it to a paid account without ending the trial period. During the remainder of the trial period, you can. You can watch Netflix premium content for free without a credit card. There are several ways to obtain a Netflix account. All the processes are legit. How to sign up for free trials without using a credit or debit card If you don't have a credit or debit card to use for gaining access to free trials, the. Without a trial period, a new credit card, which is immediately voided. Additionally, Recurly offers the option to set up free trials using coupons. But, I'm trying to create free trial without collecting credit card credit card details, which you would then save using the SetupIntent. Yes, you need to enter your credit card details to activate the Free Trial Period. Can I use ROUVY without a subscription or account? After the trial ends, you. Requiring a valid credit card to access the platform allows us to verify your identity, filter out illegitimate users, and prevent nasty stuff like spam, bots.

Can Having Multiple Credit Cards Hurt Your Credit

Ulzheimer explains that having multiple credit cards can help expand your buying power and gives you a lower balance-to-limit ratio, which helps your credit. If you apply for several credit cards within a short period of time, multiple inquiries will appear on your report. Looking for new credit can equate with. Having more than a typical amount of credit cards can lower our credit based insurance score and increase the premiums for car/home insurance. Even one late payment on a credit card account or loan can result in a credit score decrease, depending on the scoring model used. In addition, late payments. Having multiple credit cards can indirectly impact your credit scores by lowering your debt to credit ratio—also known as your credit utilization rate. Your. Applying for multiple credit cards at once may have a negative impact on your credit scores and send unintended messages to lenders. A credit card application. Having multiple credit cards is actually good for your credit score as long as you keep 0 or low balances on them. If you have not used most. If you are planning to have multiple credit cards, then you should not own them in a short span as this will decrease your average credit age thus lowering your. Applying for multiple cards in a short time period may also hurt your credit score. Does having multiple credit cards hurt your credit? A credit score is. Ulzheimer explains that having multiple credit cards can help expand your buying power and gives you a lower balance-to-limit ratio, which helps your credit. If you apply for several credit cards within a short period of time, multiple inquiries will appear on your report. Looking for new credit can equate with. Having more than a typical amount of credit cards can lower our credit based insurance score and increase the premiums for car/home insurance. Even one late payment on a credit card account or loan can result in a credit score decrease, depending on the scoring model used. In addition, late payments. Having multiple credit cards can indirectly impact your credit scores by lowering your debt to credit ratio—also known as your credit utilization rate. Your. Applying for multiple credit cards at once may have a negative impact on your credit scores and send unintended messages to lenders. A credit card application. Having multiple credit cards is actually good for your credit score as long as you keep 0 or low balances on them. If you have not used most. If you are planning to have multiple credit cards, then you should not own them in a short span as this will decrease your average credit age thus lowering your. Applying for multiple cards in a short time period may also hurt your credit score. Does having multiple credit cards hurt your credit? A credit score is.

Having multiple credit cards can hurt your credit score. When multiple card accounts are added to your collection, it's likely that your overall debt will. Yes, having more than one credit card can often add up to credit card debt if not maintained properly. Banks conduct a thorough check of your credit score. While it's good to show lenders that you can successfully manage multiple credit accounts, applying for credit too many times can raise a few red flags. When. Simply put, probably not. Applying for multiple credit cards at one time is likely to have a negative impact on your credit score. While it might make sense to. Having multiple credit cards can help—but can also hurt—your credit score. It all depends on how well you manage the cards that you have. Can You Have Two of. Having more than one credit card can help or hurt your credit score, depending on how you manage them. Here's more about the impact it can have. If all of the entries on your report are recent, there is no way for a lender to see that you will be able to pay off your loans in the long term. Before you. Having multiple credit cards can help you level up your credit score more quickly — but they can also significantly damage your credit history, if it's not. But this could end up having a negative effect on your credit scores. Each credit card application can result in a separate hard inquiry. FICO® says that a hard. As you can see from the examples above, applying for multiple credit cards can benefit some sections of your credit score and damage other sections. The good. Although using different types of credit can be a good thing, it may also hurt your score. Credit cards are considered one type of credit, so opening too many. But having multiple cards can certainly affect your score both positively and negatively. Whether you have one credit card or seven, and whether you are a young. Increased buying power: Having more credit available can increase your spending power. · More available credit: Adding another credit card account can increase. This is done to review your creditworthiness and generally results in a 5- to point drop in your credit score. Your credit score generally rebounds in a few. Does having multiple credit cards hurt your credit score? The number of credit cards you have may impact your credit score indirectly, and not always in a bad. Multiple credit cards won't necessarily harm your credit score. In fact, under the right circumstances, they can improve it. The key is to use your cards. Applying for multiple credit accounts in a short time may impact credit scores and cause lenders to view you as a higher-risk borrower. Closing a credit card. “Too many cards can hurt your credit score since the 'hard' credit check for each card application can lower your score at least temporarily,” says Cabell. Having multiple cards by itself will not necessarily hurt your score, but it makes it more likely you will underperform in one of the main areas that determine. Does having multiple credit cards affect your credit score? Yes, the number of credit cards you have will affect the credit score lenders look at when.

Canadian Chequing Account

![]()

At BMO, we have chequing accounts with low fees, cash bonuses, & no fee Interac e-Transfers®. Easily open a chequing account online in 7 minutes! Our chequing accounts have what you need to take care of your bill payments, deposits, withdrawals, and other banking activities. All our accounts offer 24 hour. A chequing account is a bank account used for everyday spending. Manage your finances and cash flow easily with one of our accounts. No Monthly Account Fees · No monthly fee; No minimum balance required · FREE, unlimited day-to-day transactions · FREE, unlimited Interac® e-Transfers · Award-. Perfect for you if you bank a lot - this chequing account offers unlimited transactions for a flat fee. • Free cheque orders, free Canadian and U.S. bank. The two largest ones are Tangerine (Scotia Bank) or Simplii (CIBC). There is also PC Financial which used to be CIBC-related I believe is now. Getting cash, paying bills and depositing checks is simple with a U.S. bank account for Canadians. Open your RBC Bank U.S. checking and savings account. With a chequing account, your basic features are free when you maintain a minimum $3, monthly balance. Feature. $3,+ monthly balance. Less than $3, This all-inclusive account lets you send money for free using Interac e-Transfer and offers unlimited transactions so you can keep climbing towards your goals. At BMO, we have chequing accounts with low fees, cash bonuses, & no fee Interac e-Transfers®. Easily open a chequing account online in 7 minutes! Our chequing accounts have what you need to take care of your bill payments, deposits, withdrawals, and other banking activities. All our accounts offer 24 hour. A chequing account is a bank account used for everyday spending. Manage your finances and cash flow easily with one of our accounts. No Monthly Account Fees · No monthly fee; No minimum balance required · FREE, unlimited day-to-day transactions · FREE, unlimited Interac® e-Transfers · Award-. Perfect for you if you bank a lot - this chequing account offers unlimited transactions for a flat fee. • Free cheque orders, free Canadian and U.S. bank. The two largest ones are Tangerine (Scotia Bank) or Simplii (CIBC). There is also PC Financial which used to be CIBC-related I believe is now. Getting cash, paying bills and depositing checks is simple with a U.S. bank account for Canadians. Open your RBC Bank U.S. checking and savings account. With a chequing account, your basic features are free when you maintain a minimum $3, monthly balance. Feature. $3,+ monthly balance. Less than $3, This all-inclusive account lets you send money for free using Interac e-Transfer and offers unlimited transactions so you can keep climbing towards your goals.

Chequing Account- ICICI Bank Canada's Basic Chequing Account is specially designed for those who only need to conduct a few banking transactions every month. A CWB Standard Chequing Account is a simple, flexible and low-fee solution for your everyday banking needs. - Available in Canadian dollars only. - Enable to issue cheques. - Monthly Fee: CAD (Minimum Daily Balance CAD1, for monthly fees to be waived). - Available in Canadian dollars only. - Enable to issue cheques. - Monthly Fee: CAD (Minimum Daily Balance CAD1, for monthly fees to be waived). We've compared chequing accounts at 19 nationally available banks and credit unions to find some of the best options available. Access over ATMs across Canada for free through THE EXCHANGE and ACCULINK networks; not just Vancity ATMs. From the big banks to credit unions, and online-first institutions, we list the best chequing accounts from all types of providers. Chequing Accounts, How to Open an Account, Click Here, Personal Banking Accounts, Apply online open your account online SBI global OAOCA. HiValue Personal Chequing Account - Open your Personal Chequing Account with ICICI Bank CANADA & get unlimited access to ABMs, direct deposits, cheque books. Open a Scotiabank International Account online in just a few easy steps. Use it to transfer money to Canada and show proof of funds before you move. We offer a variety of chequing accounts in Canada, and knowing more about you can help us suggest the chequing account that's right for you. Chequing Accounts · Available in both Canadian Dollars & US Dollars. · No Interest is paid on deposit balances lying in the chequing account (Latest Interest. CIBC Smart™ Account Get up to $ cash after you open a CIBC Smart Account, then open your first CIBC eAdvantage® Savings Account and complete all qualifying. Enjoy no fixed monthly fees for up to 3 years. Open an account online. Offer valid from your country up to 90 days before you arrive in Canada and within 5. Compare our most popular chequing accounts. Compare features. Make your pick. Open online in 7 minutes! Debit Transactions, 12/month, plus unlimited free debits for eligible public transit legal bug 6 ($ each thereafter), Unlimited in Canada, Unlimited in. $0 Monthly maintenance fees. · $0 INTERAC e-Transfer® · Free ATMs* across Canada. · Free, Unlimited Transactions. Below is a comparison of the best premium accounts in Canada to see what you can get with each, as well as the pros and cons of opening a top-tier bank account. How to open a joint account · 1. Make an appointment. Schedule an appointment online, either in person at any branch or by video call. · 2. Prepare your documents. Yes. It's possible to open a Canadian bank account from abroad if you're planning on moving to the country full time — although you may not get full account.

1 2 3 4