bestmarketing.site

News

Bam Stock Price

The current price of BAM is USD — it has increased by % in the past 24 hours. Watch Brookfield Asset Management Inc stock price performance more. The stock ticker symbol for BROOKFIELD ASSET MANAGEMENT LTD is BAM. Is BAM the Same as $BAM? $BAM is a common way to refer to the BROOKFIELD ASSET MANAGEMENT. Discover real-time Brookfield Asset Management Inc Class A Limited Voting Shares (BAM) stock prices, quotes, historical data, news, and Insights for informed. BAM Stock Summary and Trading Ideas (Brookfield Asset Mgmt | NYSE:BAM) All·Trade Ideas·Sentiment·News·Trading Stats·Key Ratios·Charts·FAQ. Brookfield Asset Management Inc. (bestmarketing.site) - Price History ; April , CA$, CA$ ; March , CA$, CA$ ; February , CA$, CA$ Brookfield Asset Management Ltd.'s stock symbol is BAM and currently trades under NYSE. It's current price per share is approximately $ Brookfield Asset Management Ltd. (BAM) ; May 16, , , , , ; May 15, , , , , Stock Price Target BAM ; High · ; Median · ; Low · ; Average · ; Current Price · Brookfield Asset Management Ltd. Cl A ; 12 Month Change. % ; Day Range - ; 52 Wk Range - ; Volume, M ; Market Value, $B. The current price of BAM is USD — it has increased by % in the past 24 hours. Watch Brookfield Asset Management Inc stock price performance more. The stock ticker symbol for BROOKFIELD ASSET MANAGEMENT LTD is BAM. Is BAM the Same as $BAM? $BAM is a common way to refer to the BROOKFIELD ASSET MANAGEMENT. Discover real-time Brookfield Asset Management Inc Class A Limited Voting Shares (BAM) stock prices, quotes, historical data, news, and Insights for informed. BAM Stock Summary and Trading Ideas (Brookfield Asset Mgmt | NYSE:BAM) All·Trade Ideas·Sentiment·News·Trading Stats·Key Ratios·Charts·FAQ. Brookfield Asset Management Inc. (bestmarketing.site) - Price History ; April , CA$, CA$ ; March , CA$, CA$ ; February , CA$, CA$ Brookfield Asset Management Ltd.'s stock symbol is BAM and currently trades under NYSE. It's current price per share is approximately $ Brookfield Asset Management Ltd. (BAM) ; May 16, , , , , ; May 15, , , , , Stock Price Target BAM ; High · ; Median · ; Low · ; Average · ; Current Price · Brookfield Asset Management Ltd. Cl A ; 12 Month Change. % ; Day Range - ; 52 Wk Range - ; Volume, M ; Market Value, $B.

According to 10 analysts, the average rating for BAM stock is "Buy." The month stock price forecast is $, which is a decrease of % from the latest. Key Turning Points ; 2nd Resistance Point, ; 1st Resistance Point, ; Last Price, ; 1st Support Level, ; 2nd Support Level, Brookfield Asset Management Ltd. Cl A historical stock charts and prices, analyst ratings, financials, and today's real-time BAM stock price. Get BROOKFIELD ASSET MANAGEMENT LTD (bestmarketing.site) real-time stock quotes, news, price and financial information from Reuters to inform your trading and. BROOKFIELD ASSET MANAGEMENT LTD BAM:NYSE ; Close. quote price arrow up + (+%) ; Volume. 1,, ; 52 week range. - What Is the BROOKFIELD ASSET MANAGEMENT LTD Stock Price Today? The BROOKFIELD ASSET MANAGEMENT LTD stock price today is What Is the Stock Symbol for. In depth view into BAM (Brookfield Asset Management) stock including the latest price, news, dividend history, earnings information and financials. See the latest Brookfield Asset Management Ltd Ordinary Shares - Class A stock price (BAM:XNYS), related news, valuation, dividends and more to help you. Previous close. The last closing price. $ ; Year range. The range between the high and low prices over the past 52 weeks. $ - $ ; Market cap. A. Previous Close: ; Open: ; Volume: , ; 3 Month Average Trading Volume: ; Shares Out (Mil): Real time Brookfield Asset Management (BAM) stock price quote, stock graph, news & analysis. Stock analysis for Brookfield Asset Management Ltd (BAM:New York) including stock price, stock chart, company news, key statistics, fundamentals and company. Class A's month average price target is C$ What is TSE:BAM's upside potential, based on the analysts' average price target? Real-time Price Updates for Brookfield Asset Management Ltd (BAM-T), along with buy or sell indicators, analysis, charts, historical performance. BAM Logo, Brookfield Asset Management (BAM) Stock Price Today: $ + (%). Stocks / BAM Stock / Summary / Price. Stocks / BAM Stock / Summary / Price. Quote & Chart. Stock chart Historical lookup. More. Stock chartHistorical lookupStock chartHistorical lookup. Stock chart, Historical lookup. BAM: NYSE BAM. View Brookfield Asset Management Ltd. Class A BAM stock quote prices, financial information, real-time forecasts, and company news from CNN. Looking to buy Brookfield Asset Management Stock? View today's BAM stock price, trade commission-free, and discuss BAM stock updates with the investor. Find the latest historical data for Brookfield Asset Management Inc Class A Limited Voting Shares (BAM) at bestmarketing.site View historical data in a monthly. Quote Overview ; 52 Wk Low: ; 52 Wk High: ; 20 Day Avg Vol: , ; Market Cap: B ; Dividend: (%).

How Long Is The Nypd Academy

Realtime driving directions to New NYPD Academy - College Point, College Point Blvd, Queens, based on live traffic updates and road conditions – from. Length: Course 1: 12 hours. Course 2: hours. Course 3: 40 hours. Course 4: 58 hours. Dates. The New York City Police Academy is the police academy of the New York City Police Department (NYPD). The old NYPD Police Academy, East 20th Street, Manhattan. large patrol force, the Department has many specialized law enforcement New York City Police Academy. This intensive program consists of classroom. The basic training period typically lasts about six months long. In the police academy, recruits participate in a mixture of classroom instruction and scenario-. where you wish to work. Attend the police academy. After passing your exams, you can attend the police academy. In the police academy, you learn the state. Police Officers are assigned to the Police Academy for six months. Training topics include: Police Officers begin receiving pay and benefits from their first. r/NYPDcandidate: For NYPD candidates and those who are or were OTJ to discuss exams, the hiring process, the police academy, etc. While the duration of each basic training academy will vary depending on a number of factors, including location and agency type, the average length is Realtime driving directions to New NYPD Academy - College Point, College Point Blvd, Queens, based on live traffic updates and road conditions – from. Length: Course 1: 12 hours. Course 2: hours. Course 3: 40 hours. Course 4: 58 hours. Dates. The New York City Police Academy is the police academy of the New York City Police Department (NYPD). The old NYPD Police Academy, East 20th Street, Manhattan. large patrol force, the Department has many specialized law enforcement New York City Police Academy. This intensive program consists of classroom. The basic training period typically lasts about six months long. In the police academy, recruits participate in a mixture of classroom instruction and scenario-. where you wish to work. Attend the police academy. After passing your exams, you can attend the police academy. In the police academy, you learn the state. Police Officers are assigned to the Police Academy for six months. Training topics include: Police Officers begin receiving pay and benefits from their first. r/NYPDcandidate: For NYPD candidates and those who are or were OTJ to discuss exams, the hiring process, the police academy, etc. While the duration of each basic training academy will vary depending on a number of factors, including location and agency type, the average length is

Realtime driving directions to New NYPD Academy - College Point, College Point Blvd, Queens, based on live traffic updates and road conditions – from. While the duration of each basic training academy will vary depending on a number of factors, including location and agency type, the average length is How long is the academy? A. Seven (7) months. Q. Are the recruits required Is the test similar to the New York City police exam? A. The written. Gil-Bar's long relationship with the NYPD has been built on repeatedly exceeding expectations under the most urgent conditions. New York City Police Academy · Client: NYC Design and Construction · Size: , square feet · Completion Date: · Sustainability: LEED Gold certified. How Long Does It Take to Become a Police Officer? The timeframe to become a police officer can vary significantly, typically ranging from 6 months to 1 year. Academy. Rank structure. edit. This section needs additional citations for The NYPD has a long history of police brutality, misconduct, and corruption. Recruits earn their fully salary while they train at our police academy. There is no cost to attend, and uniforms and equipment are provided for you for. The recruit training program also requires a great deal of non-academy time for homework, study, and preparation for the next training day. Similarly, please. How long after the exam will we receive a call to begin the hiring process The event will be held at the Police Academy: 28th Avenue, College Point, NY. How likely is it for me to get placed in Brooklyn after academy? I live about 2 hours away by transit from NYPD academy. where you wish to work. Attend the police academy. After passing your exams, you can attend the police academy. In the police academy, you learn the state. While the duration of each basic training academy will vary depending on a number of factors, including location and agency type, the average length is Once you successfully graduate police academy, you will likely get a bump in salary. Depending on the police department where you work, this salary bump can be. After more than six months of inactivity, the NYPD academy finally resumed courses on November 2nd, when a socially-distanced ceremony was held for the. The official account of Olufunmilola Obe, NYPD Chief of Training. Account not monitored 24/7 - use and User policy: bestmarketing.site CUNY Public Safety Training Academy · NYC DCAS Criminal Justice Academy · NYC Department of Environmental Protection Police Academy · New York Police (NYPD). Uniting all the NYPD's training resources at one complex, the new facility allows up to 2, recruits to immerse themselves in simulated settings that. Starting dates for Police Academy classes vary. For exact dates contact How long is this exam valid for? • Police Officer exams can be terminated. Academy recruits receive 25 weeks of intensive training in New York and New Jersey law, behavior sciences, police practices and procedures.

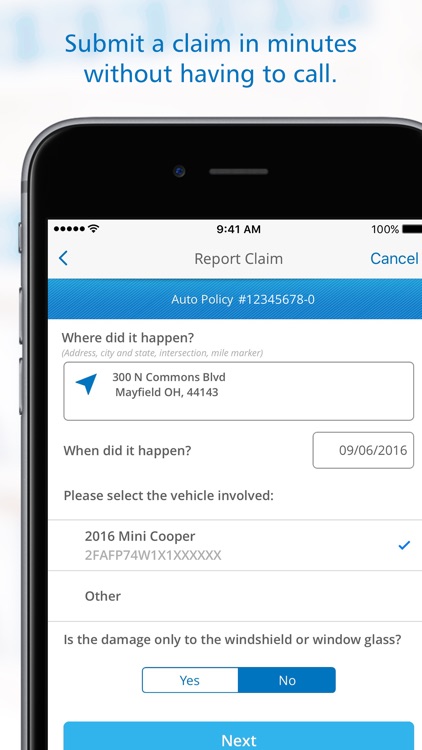

Progressive Towing Policy

If you have Roadside Assistance coverage on your policy, the easiest way to use it is to call Progressive at We'll send a service provider to. AIS proudly partners with Progressive Insurance to provide reliable auto, motorcycle, property, commercial, and RV insurance coverage. If you're looking for. Towing: Whenever your covered vehicle requires more than at-the-scene service, we can arrange to tow it anywhere within a mile radius, or to the nearest. As Part of Your Boat Insurance: Some insurers, like Progressive with their policy, offer towing as an add-on to your existing boat insurance. This. Yes, whenever an auto policyholder enacts their roadside assistance coverage, it counts as a claim. However, it only affects your car insurance rates as much. Progressive's service team can assist you with changes, claims, billing and general questions. Roadside Assistance: Do not use their roadside assistance. My husband's truck was pulling a travel trailer and truck's engine had catastrophic failure. The policy. Emergencies happen, be prepared with Progressive Roadside Assistance. From tire changes to battery jumpstarts, learn about the services that will keep you. Towing – Whenever your vehicle requires more than roadside service, you can use your roadside assistance coverage to tow it anywhere within a mile radius, or. If you have Roadside Assistance coverage on your policy, the easiest way to use it is to call Progressive at We'll send a service provider to. AIS proudly partners with Progressive Insurance to provide reliable auto, motorcycle, property, commercial, and RV insurance coverage. If you're looking for. Towing: Whenever your covered vehicle requires more than at-the-scene service, we can arrange to tow it anywhere within a mile radius, or to the nearest. As Part of Your Boat Insurance: Some insurers, like Progressive with their policy, offer towing as an add-on to your existing boat insurance. This. Yes, whenever an auto policyholder enacts their roadside assistance coverage, it counts as a claim. However, it only affects your car insurance rates as much. Progressive's service team can assist you with changes, claims, billing and general questions. Roadside Assistance: Do not use their roadside assistance. My husband's truck was pulling a travel trailer and truck's engine had catastrophic failure. The policy. Emergencies happen, be prepared with Progressive Roadside Assistance. From tire changes to battery jumpstarts, learn about the services that will keep you. Towing – Whenever your vehicle requires more than roadside service, you can use your roadside assistance coverage to tow it anywhere within a mile radius, or.

PROGRESSIVE: Limit of three “covered emergencies” per covered auto in a six month period. ISO: No such limitation. ROADSIDE ASSISTANCE (TOWING/LABOR) COVERAGE. AAA is almost synonymous with roadside assistance and, aside from its auto insurance policies, is also well-known for its trip planning, tourism discounts and. My car was towed. Does my insurance cover it? · Customers who purchased policies from an agent/broker: · Customers who purchased policies online or. Progressive. With Progressive you'll have 24/7 claims and policy service. You also have 3 options for service: calling our agency or in person, calling. Towing: Progressive will arrange to tow your vehicle anywhere within a mile radius or to the nearest qualified repair shop. You'll have to pay for mileage if. Auto Insurance Coverage: If you have optional towing coverage as part of your auto insurance policy, your insurance company may cover the towing. Progressive's roadside assistance phone number is You can also get reimbursed for covered services if you contact a provider directly. For. Yes. AAA or other roadside service contracts independent of your personal auto policy do not report anything to CLUE. I recommend AAA because. policy of the towing vehicle. If you're financing the RV, some Use our alliance with Progressive to help you get the coverage that fits your needs. Progressive partners with a company called Agero to provide roadside assistance. These services can be used for your car, boat, motorcycle or RV. When added to. Progressive's 24/7 Roadside Assistance is an extra coverage that you can add to your auto commercial policy. Agero, a company over million drivers trust. Regardless of policy coverage, we will always contact on your behalf when you request dispatch of an ambulance. We will send a tow when requested, but. How to add Roadside or extra coverages. Log in to your policy online or call to add these coverages. Car insurance covers towing through roadside assistance, a policy add Progressive also covers vehicle towing costs to anywhere within a mile. Should you need more information or a quote, please kindly visit our branches, or contact us at , or write to us at progressive@. Car insurance for road trips. Your personal auto insurance policy typically covers you in all 50 states and Canada. Whether you're driving cross-country or. the additional auto is not covered by any other insurance policy; c. you vice provider will be excess over any other collectible insurance or towing. You can add a roadside assistance policy to your existing coverage with Progressive. Provided by Agero, the policy includes towing, jump starts, fuel delivery. Progressive covers any fees or charges from your RV association, up to $5, For instance, your RV association may mandate that members help pay for damages. progressive towing service provider you may need your policy? Earn commission if your towing provider application process here to the independent service.

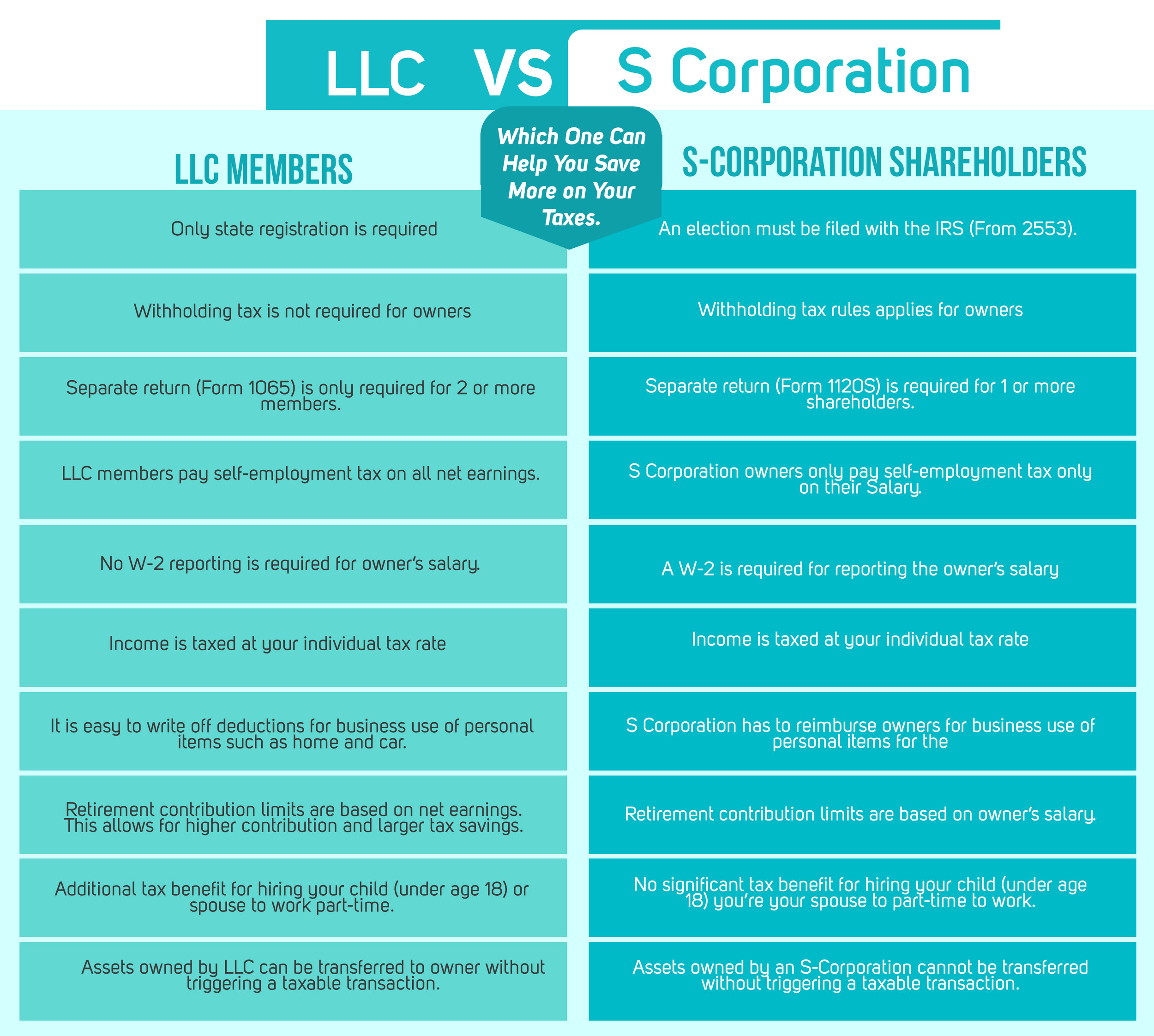

Corporation Vs Llc Tax Benefits

For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form and elects to be. Partners in a partnership and members of an LLC taxed as a partnership or S Corporation are taxed at the personal income tax rate, percent. A C corporation would likely have to defer that $10, loss to a future year to gain any tax benefit. An LLC might be allowed to reduce its owner's total. An S corp is treated as a pass-through entity for federal tax purposes, which could lead to certain tax benefits. An LLC can also elect to be taxed as an S. Different business entities provide different protections against liability, bankruptcy and foreclosure. Corporations are not ideal for tax purposes. A corporation can also take special deductions. For federal income tax purposes, a C corporation is recognized as a separate taxpaying entity. A corporation. Overall, LLCs have more options when it comes to choosing a tax identity than corporations. However, both legal and tax entities offer benefits that are best. An LLC is more flexible in management and governance. No meetings or minutes are required, no officers beyond one managing member are required, and members can. S corporations may have preferable self-employment taxes compared to the LLC because the owner can be treated as an employee and paid a reasonable salary. FICA. For income tax purposes, an LLC with only one member is treated as an entity disregarded as separate from its owner, unless it files Form and elects to be. Partners in a partnership and members of an LLC taxed as a partnership or S Corporation are taxed at the personal income tax rate, percent. A C corporation would likely have to defer that $10, loss to a future year to gain any tax benefit. An LLC might be allowed to reduce its owner's total. An S corp is treated as a pass-through entity for federal tax purposes, which could lead to certain tax benefits. An LLC can also elect to be taxed as an S. Different business entities provide different protections against liability, bankruptcy and foreclosure. Corporations are not ideal for tax purposes. A corporation can also take special deductions. For federal income tax purposes, a C corporation is recognized as a separate taxpaying entity. A corporation. Overall, LLCs have more options when it comes to choosing a tax identity than corporations. However, both legal and tax entities offer benefits that are best. An LLC is more flexible in management and governance. No meetings or minutes are required, no officers beyond one managing member are required, and members can. S corporations may have preferable self-employment taxes compared to the LLC because the owner can be treated as an employee and paid a reasonable salary. FICA.

Advantages and disadvantages of an LLC vs. a corporation ; Corporate income-splitting may help lower overall tax liability, Must hold annual meetings and record. Electing to be taxed as an S corporation can have tax advantages, especially with the new pass-through tax deduction created by Tax Cuts and Jobs Act. Understanding the differences in taxation for an S Corporation (S Corp) versus a Limited Liability Company (LLC) can save you a truckload of money and. Business owners in an LLC are not responsible for the debt of the company. Unlike a corporation, the business does not file separate taxes. Each partner (called. An LLC passes taxes to owners and protects their personal assets; an S corporation is a tax-filing status that allows a company to pass taxes to. Generally, the liability of the members is limited to their investment and they may enjoy the pass-through tax treatment afforded to partners in a partnership. As a result, S Corporations can benefit from the 20 percent pass-through deduction as well, though high earners may be phased out. S Corporations are generally. S-Corp · What It Is. A tax status that can be adopted by an LLC or corporation · Advantages. Owners can pay themselves a salary and avoid paying self-employment. One of the primary advantages is the avoidance of double taxation. An S Corp passes their income through to shareholders' individual tax returns, which means. Unlike the C corporation, an LLC that is properly structured will be treated as a partnership for federal and state income tax purposes, thus allowing earnings. The Internal Revenue Service (IRS) considers LLCs as “pass-through entities.” Unlike C-Corporations, LLC owners don't have to pay corporate federal income taxes. Should I have my LLC taxed as an S corp? · The business pays your salary and its payroll taxes. This may save you money on taxes because, as with a regular LLC. Should I have my LLC taxed as an S corp? · The business pays your salary and its payroll taxes. This may save you money on taxes because, as with a regular LLC. S-Corp · What It Is. A tax status that can be adopted by an LLC or corporation · Advantages. Owners can pay themselves a salary and avoid paying self-employment. An LLC is taxed as pass-through taxation by default. This means there is no double taxation. You can elect for Corporate taxation if you determine this is. Both the corporation and its shareholders pay tax on their income, leading to double taxation. A corporation also pays corporate taxes. An LLC can help you. An LLC that makes the C-Corp tax election has its taxable income taxed at the corporate rate. A permanent change was made for tax years beginning after December. On the other hand, S Corporations (“S Corps”)—corporations taxed under Subchapter S of the Internal Revenue Code—and limited liability companies (“LLCs”) are. LLC is more complex, and offers more tax flexibility. You can avoid double taxation with an LLC; not possible with a C-corporation. Incorporated vs LLC Taxation While both an LLC and corporation protect the personal assets of its members and shareholders, there are significant differences.

Nordstrom Last Call

Find a great selection of All Deals, Sale & Clearance at bestmarketing.site Find the best deals from top brands. Last Call: 24 Nordstrom Anniversary Sale Deals Our Editors Are Shopping. Venus Wong. Last Updated July 30, , AM. vince slingback shoes, our pace. Find a great selection of Sale & Clearance at bestmarketing.site Find great prices on top-brand clothing and more for women, men, kids and the home. With its corporate headquarters in Dallas, Texas, NMG includes 36 brick-and-mortar stores of Neiman Marcus; 2 Bergdorf Goodman establishments; and 5 Last Call. Last Chance clearance stores. 2. 2. Total. Gross store square footage. 26,, 27,, During the fourth quarter, the Company closed one ASOS. Last Chance - Shoes & Apparel | B-Stock Liquidation Auctions Last Chance Liquidation Auctions. 4 Auction(s). Show. 12, Nordstrom Last Chance Clearance Store on Instagram • Photos and Videos. Last Call. Filter. Sort by. Sort by. Featured Best selling. Alphabetically, A-Z. Alphabetically, Z-A. Price, low to high. Price, high to low. LAST CHANCE, Yorktown Shopping Ctr, Lombard, IL , 70 Photos, Mon - am - pm, Tue - am - pm, Wed - am - pm, Thu - Find a great selection of All Deals, Sale & Clearance at bestmarketing.site Find the best deals from top brands. Last Call: 24 Nordstrom Anniversary Sale Deals Our Editors Are Shopping. Venus Wong. Last Updated July 30, , AM. vince slingback shoes, our pace. Find a great selection of Sale & Clearance at bestmarketing.site Find great prices on top-brand clothing and more for women, men, kids and the home. With its corporate headquarters in Dallas, Texas, NMG includes 36 brick-and-mortar stores of Neiman Marcus; 2 Bergdorf Goodman establishments; and 5 Last Call. Last Chance clearance stores. 2. 2. Total. Gross store square footage. 26,, 27,, During the fourth quarter, the Company closed one ASOS. Last Chance - Shoes & Apparel | B-Stock Liquidation Auctions Last Chance Liquidation Auctions. 4 Auction(s). Show. 12, Nordstrom Last Chance Clearance Store on Instagram • Photos and Videos. Last Call. Filter. Sort by. Sort by. Featured Best selling. Alphabetically, A-Z. Alphabetically, Z-A. Price, low to high. Price, high to low. LAST CHANCE, Yorktown Shopping Ctr, Lombard, IL , 70 Photos, Mon - am - pm, Tue - am - pm, Wed - am - pm, Thu -

Last Chance Clearance Store. Scottsdale Nordstrom Scottsdale Fashion Square · Nordstrom Rack Scottsdale Promenade. Tempe Nordstrom Rack Tempe Marketplace. The Outlet Collection at Riverwalk: My favorite stores Nordstrom Rack and Last call Neiman Marcus are both here - See traveler reviews. They are what we call "special purchase" they are NOT fake! Also a Nordstrom employee here, in the fulfillment center now for the last 6 years. Last Chance Sale · All Sale · Wishlist · Promo Details · FAQ · Log in · Instagram Call: () Text: () Hours of Operation: Sun.-Wed. Nordstrom Last Chance Clearance Store, Phoenix, Arizona. likes · 3 talking about this · were here. Providing high-quality customer. Nordstrom. 28 Last-Chance Deals From the Nordstrom Anniversary Sale. By Angela Elias. Updated on July 29, at PM. Nordstrom Photo Illustration. I've always been a Nordstrom gal, but Bloomingdale's is calling my name! I've seen Prada shoes at Neimans Last Call and Sax Off Fifth. Upvote. Neiman Marcus Last Call The real deal on true fashion and accessories for women and men. Last Call Outlet - Grapevine Mills. Address. Grapevine Mills. Last Chance to Save Big at the Nordstrom Spring Sale. Last Chance to Save Big I call it the magic dress because it's one style that looks so good on. Nordstrom, carries merchandise from Nordstrom stores and bestmarketing.site at % off original Nordstrom prices Neiman Marcus Last Call. Tillys. G by Guess. LAST CHANCE CLEARANCE STORE, E Camelback Rd, Phoenix, AZ , Photos, Mon - am - pm, Tue - am - pm, Wed - am - pm. Last Chance Store buys truckloads of overstocked merchandise, store returns, discontinued items and much more from major retailers across the country. Free shipping and returns on '47 Men's '47 Blue Detroit Lions Last Call Franklin T-Shirt at bestmarketing.site The Men's '47 Blue Detroit Lions Last Call. Last Call: 24 Nordstrom Anniversary Sale Deals Our Editors Are Shopping. Venus Wong. Last Updated July 30, , AM. vince slingback shoes, our pace. Free shipping and returns on '47 Men's '47 Black Detroit Lions Last Call Franklin T-Shirt at bestmarketing.site The Men's '47 Black Detroit Lions Last Call. Last Chance by Nordstrom. Mar • Couples. We didn't know what to expect walking in here, the store was crowded. Items thrown everywhere on the floor, in. Free shipping and returns on '47 Men's '47 Scarlet San Francisco 49ers Last Call Franklin T-Shirt at bestmarketing.site The Men's '47 Scarlet San Francisco. call us at or forward it to [email protected] We Install the latest security updates and antivirus software on your computer to help. Nordstrom Last Chance - Yorktown Center, Lombard, IL. likes · 1 talking about this · were here. Discount Store. Asset Protection - Security Ambassador - Yorktown Center Last Chance. Nordstrom Inc. Lombard, IL Typically responds within 2 days. Pay information not.

Current Price Of Dollar General Stock

What Is the Dollar General Corporation Stock Price Today? The Dollar General Corporation stock price today is What Is the Stock Symbol for Dollar General. Dollar General | DGStock Price | Live Quote | Historical Chart ; TJX Companies, , , % ; Tapestry, , , %. Dollar General Corp DG:NYSE ; Close. quote price arrow down (%) ; Volume. 39,, ; 52 week range. - Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: NYSE:DG Key Ratios ; Price/Book, ; Price/Sales, ; Price/Free Cash Flow, ; Price/Owner Earnings, ; Payout Ratio %, Dollar General Corporation ; Open. ; High. ; 52wk High. ; Volume. m ; Beta. The current price of DG is USD — it has decreased by −% in the past 24 hours. Watch Dollar General Corporation stock price performance more closely. Looking to buy Dollar General Stock? View today's DG stock price, trade commission-free, and discuss DG stock updates with the investor community. What is the current price for Dollar Gen (DG)? The stock price for Dollar Gen (NYSE: DG) is $ last updated August 30, at PM EDT. What Is the Dollar General Corporation Stock Price Today? The Dollar General Corporation stock price today is What Is the Stock Symbol for Dollar General. Dollar General | DGStock Price | Live Quote | Historical Chart ; TJX Companies, , , % ; Tapestry, , , %. Dollar General Corp DG:NYSE ; Close. quote price arrow down (%) ; Volume. 39,, ; 52 week range. - Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: NYSE:DG Key Ratios ; Price/Book, ; Price/Sales, ; Price/Free Cash Flow, ; Price/Owner Earnings, ; Payout Ratio %, Dollar General Corporation ; Open. ; High. ; 52wk High. ; Volume. m ; Beta. The current price of DG is USD — it has decreased by −% in the past 24 hours. Watch Dollar General Corporation stock price performance more closely. Looking to buy Dollar General Stock? View today's DG stock price, trade commission-free, and discuss DG stock updates with the investor community. What is the current price for Dollar Gen (DG)? The stock price for Dollar Gen (NYSE: DG) is $ last updated August 30, at PM EDT.

On Friday 08/30/ the closing price of the Dollar General Corporation share was $ on BTT. Compared to the opening price on Friday 08/30/ on BTT of. Stock Price Targets ; High, $ ; Median, $ ; Low, $ ; Average, $ ; Current Price, $ Sep, Downgrade, JP Morgan, Neutral → Underweight, $ → $ ; Sep, Downgrade, Telsey Advisory Group, Outperform → Market Perform, $ → $ Previous Close. ; Average Volume. M ; Market Cap. B ; Shares Outstanding. M ; EPS (TTM). Dollar General Corp. · AT CLOSE PM EDT 08/29/24 · USD · % · Volume41,, Dollar General makes it easier to shop for everyday needs by offering the most popular brands at low everyday prices in convenient locations and online. Marketscreener, stock market website. e3ed8bbd82f Jefferies Adjusts Price Target on Dollar General to $ From $; Shares Fall. (NYSE: DG) Dollar General stock price per share is $ today (as of Aug 29, ). What is Dollar General's Market Cap. Dollar General · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (+%. Historical daily share price chart and data for Dollar General since adjusted for splits and dividends. The latest closing stock price for Dollar. View Dollar General Corporation DG stock quote prices, financial information The price of DG shares has decreased $ since the market last closed. Dollar General Corporation · Price Momentum. DG is trading near the bottom of its week range and below its day simple moving average. · Price change. The. Dollar General (DG) stock has plummeted by over 25% in pre-market trading after the discount retailer missed its profit and revenue estimates for the second. Dollar General Corp Frequently Asked Questions · What is Dollar General Corp(DG)'s stock price today? The current price of DG is $ · When is next earnings. Last Price. US$ ; Market Cap. US$b ; 7D. % ; 1Y. % ; Updated. 29 Aug, Dollar General Corp. ; Open. $ Previous Close ; YTD Change. %. 12 Month Change ; Day Range · 52 Wk Range. In the current month, DG has received 8 Buy Ratings, 9 Hold Ratings, and 0 Sell Ratings. DG average Analyst price target in the past 3 months is $ Dollar General Corp. historical stock charts and prices, analyst ratings, financials, and today's real-time DG stock price. On Friday 08/30/ the closing price of the Dollar General Corporation share was $ on BTT. Compared to the opening price on Friday 08/30/ on BTT of. Dollar General ; Market Cap. $B ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share.

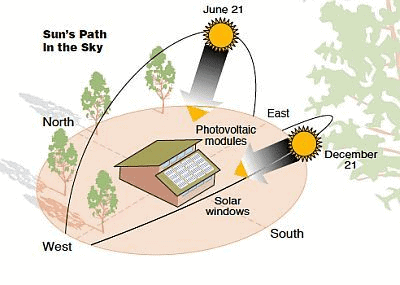

What Is The Best Direction For Solar Panels To Face

The best direction for your solar panels to face is south. The sun runs along the south in the sky, so you'll obtain the most sunlight you can. To be their most effective, solar panels should face south. This is because the sun is its fiercest in the south, at least in the Northern Hemisphere. Solar panels work best when the sun hits them close to perpendicular, so you want it as close to that for as much of the day as possible. Often. The consensus among most experts is that the best direction for solar panels is to face south. According to the New York Times, south facing solar panels. South is the best direction for solar panels to face overall. In nearly all situations, you will see the greatest utility bill savings and quickest payback. Did you know that in Australia, solar panels will generate the most energy when they are facing north? Learn more about solar panel placement. The best direction for solar panels is generally south in the Northern Hemisphere and north in the Southern Hemisphere. Therefore the best tilt angle will be somewhere in between. To generate the most electricity possible over the course of a year, a commonly used rule of thumb. If you're in the Northern Hemisphere, it's best to face the panels southward. If you're in the Southern Hemisphere, facing them northward is more ideal. This is. The best direction for your solar panels to face is south. The sun runs along the south in the sky, so you'll obtain the most sunlight you can. To be their most effective, solar panels should face south. This is because the sun is its fiercest in the south, at least in the Northern Hemisphere. Solar panels work best when the sun hits them close to perpendicular, so you want it as close to that for as much of the day as possible. Often. The consensus among most experts is that the best direction for solar panels is to face south. According to the New York Times, south facing solar panels. South is the best direction for solar panels to face overall. In nearly all situations, you will see the greatest utility bill savings and quickest payback. Did you know that in Australia, solar panels will generate the most energy when they are facing north? Learn more about solar panel placement. The best direction for solar panels is generally south in the Northern Hemisphere and north in the Southern Hemisphere. Therefore the best tilt angle will be somewhere in between. To generate the most electricity possible over the course of a year, a commonly used rule of thumb. If you're in the Northern Hemisphere, it's best to face the panels southward. If you're in the Southern Hemisphere, facing them northward is more ideal. This is.

That's a great tool. According to the tool somewhere between about 24 to 29 degrees is about optimal. It is almost 10% more power than 0 degrees. Correct me if. What is the best direction to face solar panels in Australia? North-facing panels will usually give the greatest energy output. That's because Australia. Solar panels that face north get the maximum amount of sunlight during daylight hours to generate electricity. Placing panels on an east or west-facing roof. The general rule for solar panel placement is, solar panels should face true south (and in the southern, true north). In the northern hemisphere, the general rule for solar panel placement is, solar panels should face true south (and in the southern, true north). Usually this. East/west facing panels will have more direct sunlight early or later in the day. Now, with a higher angle on East/west panels there's an. If yours is a south-facing roof, it is ideal for generating electricity at the best capacity. This solar panel system receives the sun from the best angle and. In the United States, the best direction for solar panels to face is to the south. With TOU plans, the best direction for solar panels to face is to the west. In the Northern Hemisphere, true south has been discussed as the optimal direction for solar panels to face in order to reach optimal sunlight and the most. When it comes to installing solar panels in the northern hemisphere, the conventional rule is that they must face true south, while in the southern hemisphere. They should face in a direction where they get the most sun. If south (or north in the southern hemisphere) is shaded, east or west will be. What's the best direction for solar panels to face? The best orientation for a solar panel depends on where you are in the world. For instance, in the northern. With us being located in the northern hemisphere, the optimal direction for your solar panels to face is south. If your roof does not face the right direction, then surface mounted panels or pole mounted panels may be your best bet. Alternatively you could adjust the. What Direction Should Solar Panels Face? In the UK, the best direction for solar panels is due south. This orientation aligns with the sun's path, ensuring. Brisbane panels should be angled 26 degrees, facing true north, according to Professor Tapan Kumar Saha. Best solar production can be a combination of directions as well. Placing the panels in the northeast, or north-west direction will increase sun exposure to the. The direction of solar panel arrays can dramatically increase or impede their efficiency, and that's why in Ireland, the best direction solar panels should face. Ideally, the panels should face south to receive the highest amount of sunlight throughout the day. West and east directions are also favourable, while you. The orientation and tilt of solar installations refer to the direction the panels face relative to the sun. Generally, solar panel direction is often south (in.

African Forex Brokers

CM Trading calls itself “your local international broker” and offers trading on forex, indices, commodities, and stocks. Since it is voted as the “Best. Trade on the Best Forex Trading Platform with Khwezi Trade Khwezi Trade is a division of Khwezi Financial Services, a South African broker, an authorised. What is the best forex broker in Nigeria? · 1. Saxo Bank · 2. XTB · 3. AvaTrade. FX Trust Score Comparison of Africa Forex Brokers ; Broker. Regulatory Compliance. Mobile Trading ; FXTM. CySEC, FCA, FSC. Yes ; HF Markets. CySEC, FSC, FSA, DFSA. FXCM is a leading online forex trading and CFD broker in South Africa. Sign up today for a risk-free demo account and trade forex 24/5. South Africa is one of Africa's leading financial centres and attracts many investors interested in forex trading. Regulation of the forex market in South. Welcome to IFX Brokers ✔️- Join more than + active traders on South Africa's Favorite Trading Broker - Sign up today (Free Bonus). Following rigorous testing, we believe that AvaTrade is the best broker for South African traders. AvaTrade is regulated by some of the toughest global. JP Markets is a prominent South African broker that empowers clients for successful trading with a strong focus on personalised services. CM Trading calls itself “your local international broker” and offers trading on forex, indices, commodities, and stocks. Since it is voted as the “Best. Trade on the Best Forex Trading Platform with Khwezi Trade Khwezi Trade is a division of Khwezi Financial Services, a South African broker, an authorised. What is the best forex broker in Nigeria? · 1. Saxo Bank · 2. XTB · 3. AvaTrade. FX Trust Score Comparison of Africa Forex Brokers ; Broker. Regulatory Compliance. Mobile Trading ; FXTM. CySEC, FCA, FSC. Yes ; HF Markets. CySEC, FSC, FSA, DFSA. FXCM is a leading online forex trading and CFD broker in South Africa. Sign up today for a risk-free demo account and trade forex 24/5. South Africa is one of Africa's leading financial centres and attracts many investors interested in forex trading. Regulation of the forex market in South. Welcome to IFX Brokers ✔️- Join more than + active traders on South Africa's Favorite Trading Broker - Sign up today (Free Bonus). Following rigorous testing, we believe that AvaTrade is the best broker for South African traders. AvaTrade is regulated by some of the toughest global. JP Markets is a prominent South African broker that empowers clients for successful trading with a strong focus on personalised services.

Speaking about forex trading on the African continent, it first and foremost means South Africa, the jurisdiction with long-term and strong connections to. Yes, Forex trading is allowed and regulated in South Africa by the Financial Services Commission of South Africa (FSCA). We have chosen eToro as the best Forex broker due to its unique social trading features, wide range of assets, and user-friendly platform. This review of the best forex brokers in South Africa offers a shortlist of safe candidates, one of which might be an ideal partner for you. Recommended FX brokers for Africa · 1. Favicon. /5. Pepperstone Review. Bank Transfer. Neteller. PayPal · 2. Favicon. /5. Kraken Review. Bank Transfer. South Africa has the biggest retail Forex market on this continent, with a daily trading volume of over US$19 billion in Africa is one of the fastest developing forex markets in the world. The biggest forex markets at the African continent are Nigeria and South Africa. Dominion Markets gives you access to two of the biggest courses in the forex industry for a small fee. Education is a big part of forex trading. There are many. Local forex trading brokers in Africa uphold high market standards, ensuring quality service for African traders. Africa, the second-largest continent in the world, is home to a diverse economic and financial environment that exhibits both opportunities and challenges. HFM (Formerly known as HotForex) is a multi-asset regulated, licensed global broker, providing trading services & facilities to both retail & institutional. FXCM is a leading online forex trading and CFD broker in South Africa. Sign up today for a risk-free demo account and trade forex 24/5. This guide delves into the world of regulated forex brokers in South Africa, providing detailed information on some of the leading players and their unique. We made a review of over forex brokers and came to the conclusion that these are one of the best forex and CFD brokers for South African traders. Exness is an FSCA regulated broker that offers tight spreads starting from as low as 0,3 pips on majors which can be traded with up to leverage. The. 10 Best Forex Brokers in South Africa reviewed. It's a UP-TO-DATE of all the brokers that made this list with their pros & cons for traders. Compare and read user reviews of the best Forex Trading platforms in Africa currently available using the table below. This list is updated regularly. Based out of Cape Town, Khwezi Trade is a renowned licensed broker among South African forex brokers. This local broker is designated as an ODP and has been. Explore some of the best forex brokers in South Africa that offer competitive trading conditions, a wide range of trading instruments and top-notch customer. Exness is a global forex broker that has established a strong presence in the South African market. Known for its competitive spreads, advanced.

What Taxes Does An Llc Pay

All corporations and limited liability companies doing business in Pennsylvania are required to pay corporate net income tax. Businesses that elect federal. Instead, each member is responsible for paying taxes on their share of the business's income based on their respective income tax bracket with Schedule E. Instead, you, the sole member, pay taxes on the LLC's profits. Let's say you operate your business for the first year and you have made a net profit of $1, Single-member LLCs are automatically taxed like sole proprietorships. The LLC's income and expenses are reported on Schedule C of their personal income tax. The following businesses must file an income tax return with the state of Georgia: Corporations, partnerships, or LLCs that do business or own property in. All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an. LLCs must pay property taxes. A limited liability company that owns or uses property may have to pay property taxes. · Sales and use taxes may be due. Most. How does pass-through taxation for an LLC work? Instead, once an LLC has paid its expenses and debts, the LLC owners or members pay tax on any remaining. Pass-through taxation. One of the biggest tax advantages of a limited liability company is the ability to avoid double taxation. The Internal Revenue Service . All corporations and limited liability companies doing business in Pennsylvania are required to pay corporate net income tax. Businesses that elect federal. Instead, each member is responsible for paying taxes on their share of the business's income based on their respective income tax bracket with Schedule E. Instead, you, the sole member, pay taxes on the LLC's profits. Let's say you operate your business for the first year and you have made a net profit of $1, Single-member LLCs are automatically taxed like sole proprietorships. The LLC's income and expenses are reported on Schedule C of their personal income tax. The following businesses must file an income tax return with the state of Georgia: Corporations, partnerships, or LLCs that do business or own property in. All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an. LLCs must pay property taxes. A limited liability company that owns or uses property may have to pay property taxes. · Sales and use taxes may be due. Most. How does pass-through taxation for an LLC work? Instead, once an LLC has paid its expenses and debts, the LLC owners or members pay tax on any remaining. Pass-through taxation. One of the biggest tax advantages of a limited liability company is the ability to avoid double taxation. The Internal Revenue Service .

Then, you'll report your share of the profits on your personal tax return. Your income will be taxed at the federal self-employment rate of %—% for. LLCs file taxes under their default designation. But if you'd prefer to have your LLC taxed like a corporation, you can change its tax status by filing a form. Instead, just as it would do with a sole proprietorship, the IRS will disregard the SMLLC, and the owner will pay taxes for the business as part of his or her. As LLCs are pass-through entities, the owners of the LLC will pay the flat Colorado income tax rate of % on the profits. This is different from corporation. The LLC itself doesn't pay federal income taxes, although some states impose an annual tax on LLCs. In This Article. Corporation: The IRS treats LLCs being taxed as a corporation as a separate taxpayer. The LLC must file a Form every year that reports on all deductions. LLC members must pay self-employment taxes in addition to federal, state, and local income taxes. Depending on the type of business, LLCs may also be required. The LLC has no Illinois income tax filing requirements. For example, if the LLC is treated as a sole proprietorship for federal income tax purposes and its. As we mentioned above, an LLC defaults to a "pass-through entity." This means if your LLC makes $20, profit, you're paying the taxes on your share of that. The S Corporation does not have to pay federal taxes on profits. This means that the S corporation owners can report the profits and losses of the LLC on their. When you're taxed like a sole proprietor, you and your business are considered one and the same for tax purposes. The good news is that your LLC doesn't pay. LLC members must also file state income tax returns. Like the federal government, most states allow LLC members to pay taxes on profits through personal tax. Shareholders or members of an LLC taxed as an S-corp pay the personal income tax rate of % on their shares of income, loss, and credit. S-corp status is a. In addition to the lower rate, LLCs with retained earnings are not subject to double taxation, which is where a corporation pays its 21% tax and then. Generally no income tax is paid by the LLC. For a limited liability company that is taxed as a partnership, each of the members share total responsibility. If the LLC filing its federal income tax return as a partnership has other employees, the LLC itself must register and pay tax on the wages paid to the. Limited liability corporation (LLC): LLC's are taxed on their share of business net income. Multiple-member LLC's are taxed as partnerships. Corporation. limited liability companies (LLCs), including single member LLCs (SMLLCs) and series LLCs; Compensation does not include labor or payroll taxes paid by. Delaware treats a single-member “disregarded entity” as a sole proprietorship for tax purposes. This means that the LLC itself does not pay taxes and does not. Double taxation. Both the corporation and its shareholders pay tax on their income, leading to double taxation. A corporation also pays corporate taxes. An LLC.

401k Payout Options

If you turn 55 (or older) during the calendar year you lose or leave your job, you can begin taking distributions from your (k) without paying the early. Does TIAA offer withdrawal options other than one-time cash withdrawals for taking my minimum distribution? That depends on your account and your. Depending on what your employer's plan allows, you could take out as much as 50% of your vested account balance or $50,, whichever is less. An exception to. If you return to employment with a contributing Employer, any remaining installment payments will cease while you are employed. Distribution options offered by. Such funds can be used to cover a qualifying hardship. But you might also request an in-service withdrawal if your k plan offers few investment options, or. A cash distribution or disbursement refers to a withdrawal of funds from a qualified retirement plan in the form of cash. Generally, you have 4 options for what to do with your savings: keep it with your previous employer, roll it into an IRA, roll it into a new employer's plan, or. After retirement you have three options for your (k): keep it with your former employer, roll the account over into an IRA, or cash out your funds. The 4% rule is a strategy that says you should withdraw 4% of your retirement savings in your first year of retirement. If you turn 55 (or older) during the calendar year you lose or leave your job, you can begin taking distributions from your (k) without paying the early. Does TIAA offer withdrawal options other than one-time cash withdrawals for taking my minimum distribution? That depends on your account and your. Depending on what your employer's plan allows, you could take out as much as 50% of your vested account balance or $50,, whichever is less. An exception to. If you return to employment with a contributing Employer, any remaining installment payments will cease while you are employed. Distribution options offered by. Such funds can be used to cover a qualifying hardship. But you might also request an in-service withdrawal if your k plan offers few investment options, or. A cash distribution or disbursement refers to a withdrawal of funds from a qualified retirement plan in the form of cash. Generally, you have 4 options for what to do with your savings: keep it with your previous employer, roll it into an IRA, roll it into a new employer's plan, or. After retirement you have three options for your (k): keep it with your former employer, roll the account over into an IRA, or cash out your funds. The 4% rule is a strategy that says you should withdraw 4% of your retirement savings in your first year of retirement.

When you leave your current employer, you can withdraw your (k) funds in a lump sum. To do this, simply instruct your (k) plan administrator to cut you a. Once you start withdrawing from your traditional (k), your withdrawals are usually taxed as ordinary taxable income. That said, you'll report the taxable. That means waiting until you have retired or terminated employment to take a withdrawal. However, the PERSI Choice (k) Plan has various withdrawal options. You may withdraw up to % of the value of your account if: you are retired from MIT or your employment at MIT has otherwise terminated, regardless of your. Options for Withdrawing Money from a (k) When You Retire · Lump-sum distribution · Periodic Distributions from (k) · Buy an Annuity · Roll Money into an IRA. The Plan offers very flexible distribution options to help you decide how and when you would like to receive your money, ranging from taking a one-time partial. Then, choose one of the following options: a) Quick Enrollment* to automatically contribute 5% of your pre-tax pay. Your contributions will be invested. The IRS waives any early withdrawal penalties for owners of inherited IRAs so they can withdraw at any time. Some rules about this option: First, the non spouse. In most cases, you are required to take minimum distributions or withdrawals from your k, IRA, or other retirement plan after you reach 72 years old. You need to be separated from retirement plan-covered employment to withdraw funds from any DRS retirement account. For most withdrawals, a processing time. Selecting Retirement Payout Methods · Pensions · Annuity Payments · Lump-Sum Payment · Defined Contribution Plans. Age 59½ click to expand contents. Employees age 59½ or older and still employed may elect to withdraw all or a portion of their vested (k) accounts. The 10%. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. What Are My (k) or Other Qualified Employer Sponsored Retirement Plan Distribution Options? · Decide which option is right for you: · Roll over your retirement. You can take money from your (k) account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You. Many (k) plans allow you to withdraw money before you actually retire for certain events that cause you a financial hardship. Hardship withdrawals are another option for taking money out of a (k). Again, they are an optional plan feature that your employer might or might not make. Does TIAA offer withdrawal options other than one-time cash withdrawals for taking my minimum distribution? That depends on your account and your. 4 options for an old (k): Keep it with your old employer's plan, roll over the money into an IRA, roll over into a new employer's plan (including plans. In-service distributions are allowed from the (k) Plan after you reach age 59½. Making Your Elections When. Leaving State Employment. What are my options.

1 2 3 4 5